packages_to_install <- c("RJDemetra", "remotes")

packages <- packages_to_install[! packages_to_install %in% installed.packages()[,"Package"]]

if (length(packages) > 0) {

install.packages(packages)

}

packages_to_install_git <- c("rjd3toolkit", "rjd3x13", "rjd3tramoseats", "rjd3providers", "rjdemetra3")

packages_git <- packages_to_install_git[! packages_to_install_git %in% installed.packages()[,"Package"]]

if (length(packages_git) > 0) {

# # Configurer si besoin le proxy

# proxy <- "proxy_a_definir"

# Sys.setenv(HTTPS_PROXY = proxy)

remotes::install_github(

sprintf("rjdemetra/%s", packages_git),

# option utile dans certaines installations portables de Java :

INSTALL_opts = "--no-multiarch")

}

library(RJDemetra)1 - R et JDemetra+

Désaisonnaliser une série temporelle

L’objectif de ce TP est d’apprendre à manipuler JDemetra+ sous R à travers le package RJDemetra.

Pour manipuler JDemetra+ sous R il y a actuellement deux façons :

Utiliser le JWSACruncher qui permet, à partir de la console, de mettre à jour un workspace JDemetra+ et d’exporter les résultats sans devoir ouvrir le logiciel. Pour faciliter son utilisation depuis R, le package

rjwsacruncherpeut être utilisé (voir TP5 - JDemetra+ en production).Utiliser le package

RJDemetraqui permet d’effectuer des désaisonnalisations avec les mêmes algorithmes et paramètres que JDemetra+ et de manipuler des workspaces.

Dans ce TP on utilisera les données du package RJDemetra mais n’hésitez pas à utiliser vos propres séries !

Pour faire de la désaisonnalisation sous R il existe plusieurs packages :

seasonaletx12qui permettent de faire du X-13ARIMA-SEATS en utilisant les programmes du US Census BureauRJDemetraqui est une interface R à JDemetra+ et c’est ce package que l’on va étudier.

RJDemetra est sur le CRAN et se base sur les librairies Java de JDemetra+. Pour l’utiliser il faut avoir Java 8 ou plus. En cas de problème d’installation voir la page : https://github.com/jdemetra/rjdemetra/wiki/Installation-manual.

Le package a aussi un site web (https://jdemetra.github.io/rjdemetra/).

RJDemetra permet :

De faire des modèles RegARIMA, TRAMO-SEATS and X-13-ARIMA comme dans JDemetra+ en définissant sa propre spécification

Manipuler les workspaces de JDemetra+ :

Importer les modèles workspaces sauvegardés par JDemetra+

Exporter les modèles créés sous RJDemetra

Une nouvelle version de RJDemetra est en cours de développement autour de la version 3.0 de JDemetra+. Elle nécessite toutefois d’avoir une version de Java supérieure à la version 17 et elle n’est pas sur le CRAN. Les fonctionnalités de RJDemetra (et les nouvelles) sont divisées en plusieurs packages disponibles sous https://github.com/rjdemetra. Dans cette formation, nous utiliserons les packages suivants RJDemetra, rjd3toolkit, rjd3tramoseats, rjd3providers, rjdemetra3 :

1 RJDemetra v2

Commencez par charger le package RJDemetra :

library(RJDemetra)1.1 Créer une specification

Dans les prochains exercices, la série utilisée sera ipi_c_eu[, "FR"] qui est l’IPI français. Vous pouvez bien sûr adapter le code pour utiliser vos propres séries. Les fonctions utilisées seront x13(), x13_spec(), regarima_x13, regarima_x13_spec ou regarima. Le détail des spécifications pré-définies par JDemetra+ sont disponibles ici.

Faire la désaisonnalisation d’une série avec X-13 avec la spécification suivante :

détection automatique du schéma de décomposition, des outliers et du modèle ARIMA ;

une correction des jours ouvrables “working days” et un effet graduel de Pâques.

Faire ensuite un graphique avec la série brute et la série désaisonnalisée.

Utiliser la spécification RSA4c pour la désaisonnalisation.

Si le modèle créé s’appelle mysa, regarder les valeurs de mysa$final, mysa$final$series et mysa$final$forecasts.

library(RJDemetra)

mysa <- x13(ipi_c_eu[, "FR"], spec = "RSA4c")

mysaRegARIMA

y = regression model + arima (2, 1, 1, 0, 1, 1)

Log-transformation: no

Coefficients:

Estimate Std. Error

Phi(1) 0.05291 0.108

Phi(2) 0.18672 0.074

Theta(1) -0.52137 0.103

BTheta(1) -0.66132 0.042

Estimate Std. Error

Week days 0.6927 0.031

Leap year 2.0903 0.694

Easter [1] -2.5476 0.442

TC (4-2020) -35.6481 2.092

AO (3-2020) -21.1492 2.122

AO (5-2011) 13.1869 1.810

LS (11-2008) -9.2744 1.758

LS (1-2009) -7.2838 1.756

Residual standard error: 2.193 on 346 degrees of freedom

Log likelihood = -795.1, aic = 1616 aicc = 1617, bic(corrected for length) = 1.767

Decomposition

Monitoring and Quality Assessment Statistics:

M stats

M(1) 0.127

M(2) 0.079

M(3) 1.094

M(4) 0.558

M(5) 1.093

M(6) 0.022

M(7) 0.085

M(8) 0.242

M(9) 0.064

M(10) 0.261

M(11) 0.247

Q 0.355

Q-M2 0.389

Final filters:

Seasonal filter: 3x5

Trend filter: 13 terms Henderson moving average

Final

Last observed values

y sa t s i

Jan 2020 101.0 102.87273 103.0457 -1.8727280 -0.1730003

Feb 2020 100.1 103.69025 103.0626 -3.5902540 0.6276448

Mar 2020 91.8 82.69170 103.2654 9.1083000 -20.5736602

Apr 2020 66.7 66.55184 103.6945 0.1481625 -37.1426277

May 2020 73.7 79.28883 104.1379 -5.5888279 -24.8490764

Jun 2020 98.2 87.35362 104.4539 10.8463757 -17.1002284

Jul 2020 97.4 92.26057 104.5518 5.1394323 -12.2912806

Aug 2020 71.7 97.54392 104.3369 -25.8439193 -6.7929846

Sep 2020 104.7 97.75728 103.8361 6.9427184 -6.0788659

Oct 2020 106.7 97.87016 103.1969 8.8298396 -5.3267823

Nov 2020 101.6 100.01475 102.6601 1.5852540 -2.6453446

Dec 2020 96.6 99.61740 102.4081 -3.0173983 -2.7907314

Forecasts:

y_f sa_f t_f s_f i_f

Jan 2021 94.29728 101.0937 102.3876 -6.7963909 -1.2939310

Feb 2021 97.89298 101.6869 102.4525 -3.7939488 -0.7655396

Mar 2021 113.65190 102.1478 102.4593 11.5041248 -0.3115701

Apr 2021 102.34532 102.1806 102.3419 0.1647274 -0.1612727

May 2021 96.14552 101.6436 102.1712 -5.4980759 -0.5276194

Jun 2021 112.15785 101.2156 102.0241 10.9422549 -0.8085520

Jul 2021 104.38495 101.5439 101.9635 2.8410057 -0.4195241

Aug 2021 79.02901 102.3820 102.0412 -23.3530134 0.3408366

Sep 2021 109.40288 102.3705 102.1977 7.0323700 0.1728109

Oct 2021 108.22472 101.8558 102.3655 6.3689511 -0.5096780

Nov 2021 106.22014 102.4265 102.5266 3.7936049 -0.1000754

Dec 2021 99.67523 102.9462 102.6812 -3.2709156 0.2649189

Diagnostics

Relative contribution of the components to the stationary

portion of the variance in the original series,

after the removal of the long term trend

Trend computed by Hodrick-Prescott filter (cycle length = 8.0 years)

Component

Cycle 1.830

Seasonal 51.089

Irregular 0.927

TD & Hol. 2.179

Others 44.916

Total 100.941

Combined test in the entire series

Non parametric tests for stable seasonality

P.value

Kruskall-Wallis test 0.000

Test for the presence of seasonality assuming stability 0.000

Evolutive seasonality test 0.014

Identifiable seasonality present

Residual seasonality tests

P.value

qs test on sa 0.924

qs test on i 0.643

f-test on sa (seasonal dummies) 0.671

f-test on i (seasonal dummies) 0.453

Residual seasonality (entire series) 0.415

Residual seasonality (last 3 years) 0.954

f-test on sa (td) 0.091

f-test on i (td) 0.333

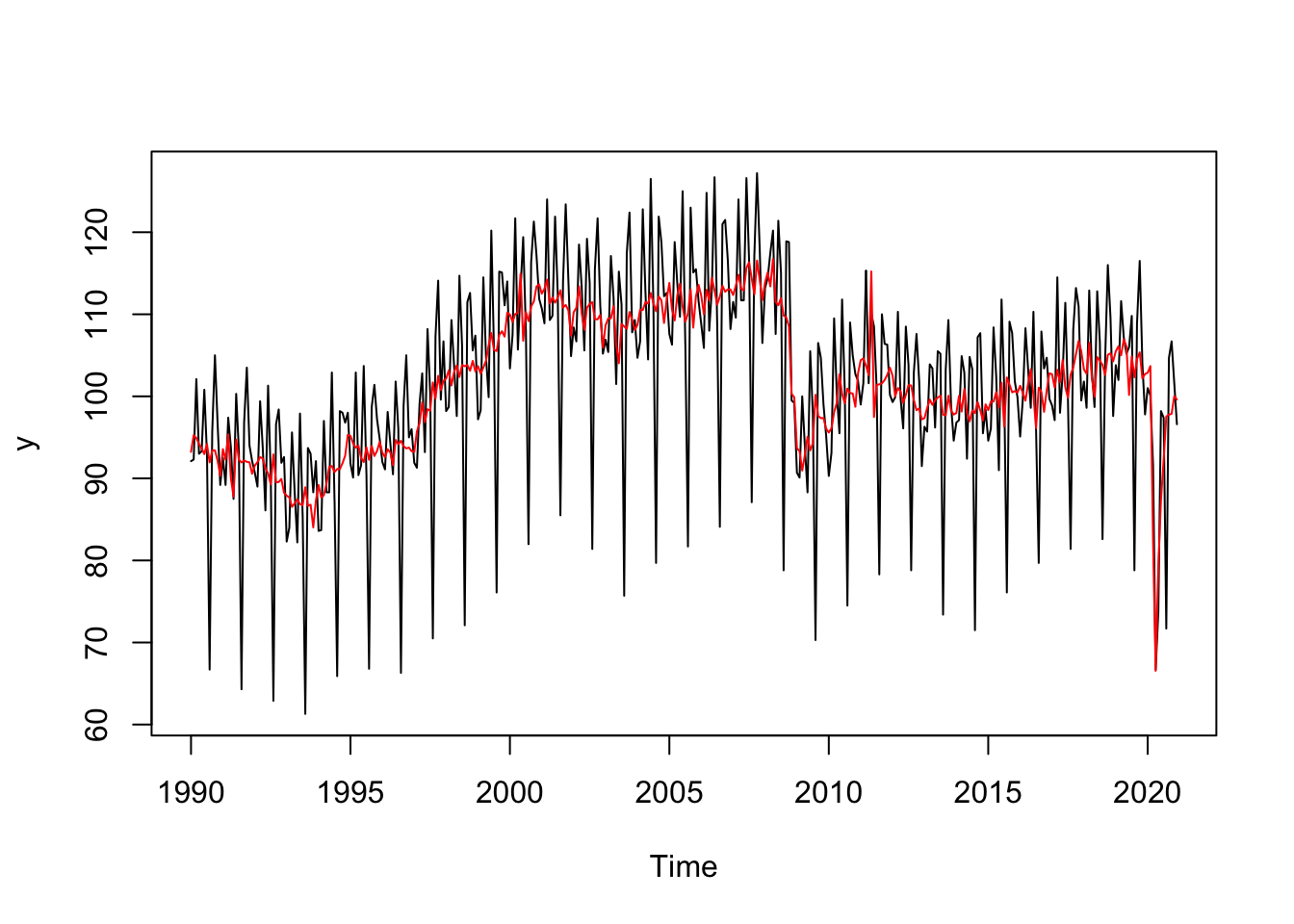

Additional output variablesy <- mysa$final$series[,"y"]

# De façon équivalente :

y <- get_ts(mysa)

sa <- mysa$final$series[,"sa"]

plot(y)

lines(sa, col = "red")

# ou on peut directement utiliser les fonctions de RJDemetra :

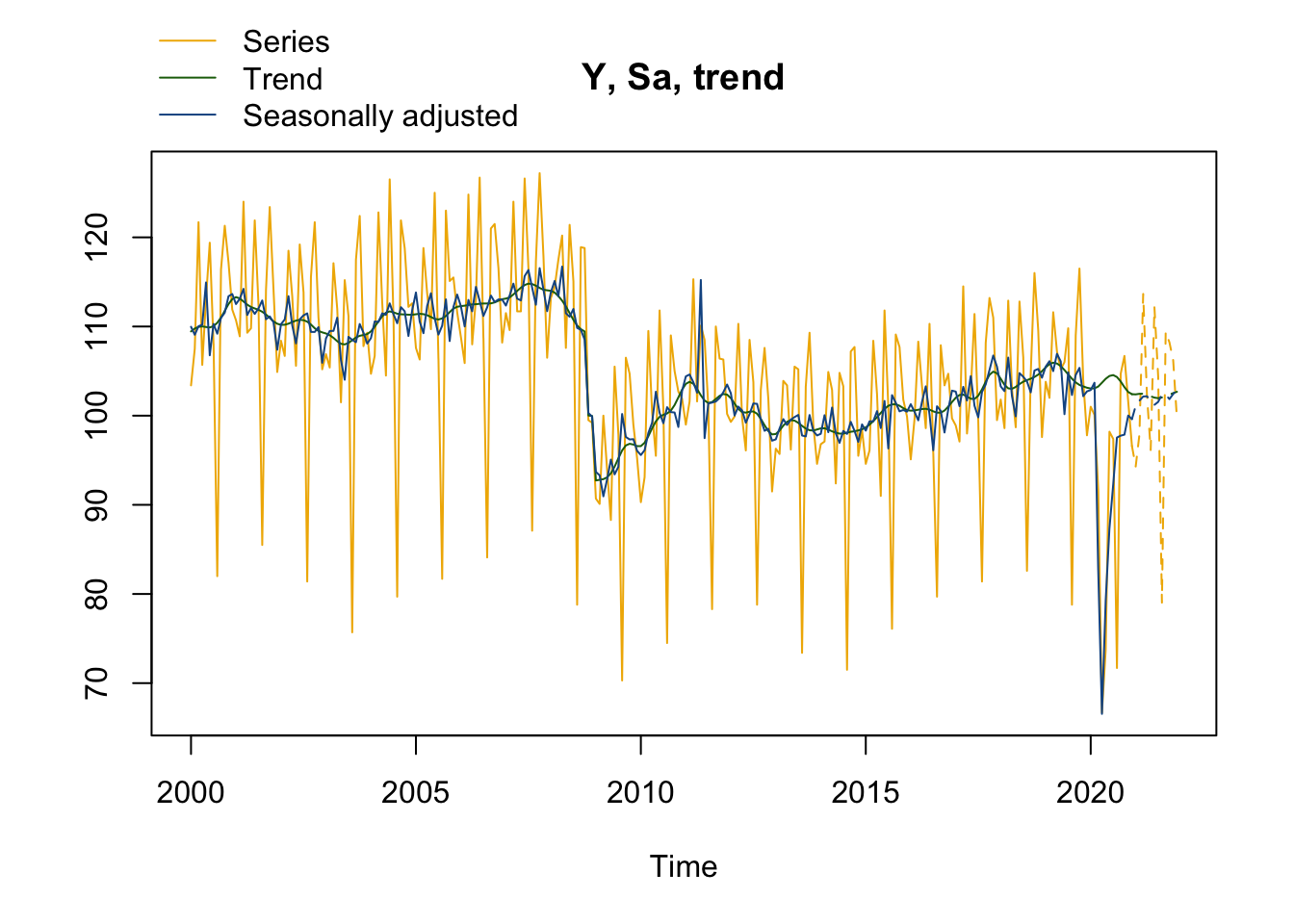

plot(mysa, first_date = 2000, #Pour n'afficher le graphique qu'à partir de 200

type_chart = "sa-trend" # Pour faire le graphique avec y, sa et tendance

)

Pour des graphiques ggplot2, on peut également utiliser le package ggdemetra :

library(ggdemetra)

# y <- ggdemetra::raw(mysa)

# sa <- ggdemetra::seasonaladj(mysa)

p_sa <-

ggplot(data = ggdemetra::ts2df(y),

mapping = aes(x = date, y = y)) +

geom_line(color = "#F0B400") +

labs(title = "Y, Sa, Trend",

x = NULL, y = NULL) +

geom_sa(component = "y_f", linetype = 2,

spec = x13_spec(mysa), frequency = 12,

color = "#F0B400") +

geom_sa(component = "sa", color = "#155692") +

geom_sa(component = "sa_f", color = "#155692", linetype = 2)+

geom_sa(component = "t", color = "#1E6C0B") +

geom_sa(component = "t_f", color = "#1E6C0B", linetype = 2) +

theme_bw()Modifier le modèle précédent pour enlever l’effet graduel de Pâques.

spec_sans_easter <- x13_spec(mysa,

easter.enabled = FALSE)

mysa2 <- x13(ipi_c_eu[, "FR"], spec_sans_easter)

mysa2$regarimay = regression model + arima (2, 1, 1, 0, 1, 1)

Log-transformation: yes

Coefficients:

Estimate Std. Error

Phi(1) 0.05032 0.118

Phi(2) 0.09575 0.082

Theta(1) -0.55559 0.110

BTheta(1) -0.73033 0.039

Estimate Std. Error

Week days 0.007179 0.000

AO (5-2011) 0.124297 0.018

LS (11-2008) -0.086926 0.017

LS (1-2009) -0.071005 0.017

Residual standard error: 0.02133 on 338 degrees of freedom

Log likelihood = 838, aic = 1548 aicc = 1548, bic(corrected for length) = -7.561Calculer les p-valeurs associées au modèle Reg-ARIMA de la précédente spécification.

Récupérer le modèle Reg-ARIMA et utiliser la fonction summary().

reg_sum <- summary(mysa2$regarima)

reg_sumy = regression model + arima (2, 1, 1, 0, 1, 1)

Model: RegARIMA - X13

Estimation span: from 1-1990 to 12-2019

Log-transformation: yes

Regression model: no mean, trading days effect(1), no leap year effect, no Easter effect, outliers(3)

Coefficients:

ARIMA:

Estimate Std. Error T-stat Pr(>|t|)

Phi(1) 0.05032 0.11801 0.426 0.670

Phi(2) 0.09575 0.08224 1.164 0.245

Theta(1) -0.55559 0.10956 -5.071 6.45e-07 ***

BTheta(1) -0.73033 0.03938 -18.545 < 2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Regression model:

Estimate Std. Error T-stat Pr(>|t|)

Week days 0.0071788 0.0003171 22.637 < 2e-16 ***

AO (5-2011) 0.1242970 0.0180390 6.890 2.63e-11 ***

LS (11-2008) -0.0869263 0.0171661 -5.064 6.69e-07 ***

LS (1-2009) -0.0710049 0.0171449 -4.141 4.34e-05 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.02133 on 338 degrees of freedom

Log likelihood = 838, aic = 1548, aicc = 1548, bic(corrected for length) = -7.561On peut récupérer ces valeurs en exploitant l’objet reg_sum :

reg_sum$coefficients$arima

Estimate Std. Error T-stat Pr(>|t|)

Phi(1) 0.05031546 0.11801332 0.426354 6.701142e-01

Phi(2) 0.09575287 0.08224054 1.164303 2.451013e-01

Theta(1) -0.55559277 0.10955864 -5.071191 6.449100e-07

BTheta(1) -0.73033107 0.03938071 -18.545401 0.000000e+00

$regression

Estimate Std. Error T-stat Pr(>|t|)

Week days 0.007178836 0.0003171301 22.636876 0.000000e+00

AO (5-2011) 0.124296961 0.0180390210 6.890449 2.628564e-11

LS (11-2008) -0.086926347 0.0171661398 -5.063826 6.685537e-07

LS (1-2009) -0.071004892 0.0171448840 -4.141462 4.338403e-05

$fixed_out

NULL

$fixed_var

NULL1.2 Créer un workspace

Dans cette partie nous allons créer un workspace depuis R. Pour cela les fonctions qui peuvent être utilisées sont new_workspace(), load_workspace(), new_multiprocessing(), add_sa_item(), save_workspace(), compute(), get_object(), get_name(), get_ts() ou count().

Créer un workspace qui va contenir une série désaisonnalisée selon 3 spécifications différentes.

jws <- new_workspace()

new_multiprocessing(jws, "MP-1")

add_sa_item(jws, "MP-1", mysa, "X13 avec Pâques")

add_sa_item(jws, "MP-1", mysa2, "X13 sans Pâques")

add_sa_item(jws, "MP-1", tramoseats(ipi_c_eu[, "FR"]), "TRAMO-SEATS")

save_workspace(jws, "mon_premier_workspace.xml")Importer le workspace précédent et récupérer :

- Le nom du premier multi-processing

- Le nombre de modèles dans ce premier multi-processing

- L’ensemble des séries brutes

- Le 2ème modèle

jws <- load_workspace("mon_premier_workspace.xml")

compute(jws)

count(jws) # Nombre de multiprocessing[1] 1jmp1 <- get_object(jws, 1) # Le premier multiprocessing

get_name(jmp1)[1] "MP-1"count(jmp1)[1] 3all_y <- get_ts(jmp1) # toutes les séries brutes

model2 <- get_object(jmp1, 2) # On récupère l'objet associé au 2ème modèle

get_model(model2, jws)RegARIMA

y = regression model + arima (2, 1, 1, 0, 1, 1)

Log-transformation: yes

Coefficients:

Estimate Std. Error

Phi(1) 0.05032 0.118

Phi(2) 0.09575 0.082

Theta(1) -0.55559 0.110

BTheta(1) -0.73033 0.039

Estimate Std. Error

Week days 0.007179 0.000

AO (5-2011) 0.124297 0.018

LS (11-2008) -0.086926 0.017

LS (1-2009) -0.071005 0.017

Residual standard error: 0.02133 on 338 degrees of freedom

Log likelihood = 838, aic = 1548 aicc = 1548, bic(corrected for length) = -7.561

Decomposition

Monitoring and Quality Assessment Statistics:

M stats

M(1) 0.080

M(2) 0.044

M(3) 0.925

M(4) 0.324

M(5) 1.018

M(6) 0.172

M(7) 0.075

M(8) 0.207

M(9) 0.069

M(10) 0.229

M(11) 0.207

Q 0.311

Q-M2 0.344

Final filters:

Seasonal filter: 3x5

Trend filter: 13 terms Henderson moving average

Final

Last observed values

y sa t s i

Jan 2019 103.9 104.9497 104.8872 0.9899977 1.0005966

Feb 2019 101.9 106.2130 105.1277 0.9593928 1.0103234

Mar 2019 111.0 104.7070 105.2207 1.0601007 0.9951182

Apr 2019 107.4 105.0688 105.1200 1.0221871 0.9995130

May 2019 105.5 108.7078 104.9337 0.9704918 1.0359658

Jun 2019 105.8 101.5038 104.6881 1.0423256 0.9695826

Jul 2019 110.1 105.4918 104.3766 1.0436828 1.0106850

Aug 2019 78.7 102.6361 104.0097 0.7667871 0.9867928

Sep 2019 108.5 104.0439 103.5870 1.0428287 1.0044106

Oct 2019 116.8 104.5857 103.1442 1.1167879 1.0139754

Nov 2019 103.8 101.7786 102.7722 1.0198610 0.9903319

Dec 2019 97.7 101.5883 102.5735 0.9617252 0.9903948

Forecasts:

y_f sa_f t_f s_f i_f

Jan 2020 101.86190 102.9804 102.5981 0.9891385 1.0037265

Feb 2020 100.79119 103.1440 102.8002 0.9771887 1.0033443

Mar 2020 111.43956 102.5781 103.0224 1.0863878 0.9956869

Apr 2020 105.54428 103.3790 103.2028 1.0209447 1.0017079

May 2020 96.34392 104.3346 103.2155 0.9234131 1.0108422

Jun 2020 112.45079 102.5347 103.0496 1.0967099 0.9950029

Jul 2020 106.92345 102.3231 102.8558 1.0449593 0.9948203

Aug 2020 76.61765 102.5744 102.7208 0.7469472 0.9985747

Sep 2020 110.47115 103.3476 102.6644 1.0689277 1.0066554

Oct 2020 111.53872 102.2010 102.6987 1.0913668 0.9951530

Nov 2020 104.52886 102.5479 102.7719 1.0193176 0.9978206

Dec 2020 101.73775 103.4319 102.9459 0.9836210 1.0047204

Diagnostics

Relative contribution of the components to the stationary

portion of the variance in the original series,

after the removal of the long term trend

Trend computed by Hodrick-Prescott filter (cycle length = 8.0 years)

Component

Cycle 1.984

Seasonal 62.978

Irregular 0.998

TD & Hol. 2.273

Others 33.676

Total 101.909

Combined test in the entire series

Non parametric tests for stable seasonality

P.value

Kruskall-Wallis test 0.000

Test for the presence of seasonality assuming stability 0.000

Evolutive seasonality test 0.429

Identifiable seasonality present

Residual seasonality tests

P.value

qs test on sa 1.000

qs test on i 0.965

f-test on sa (seasonal dummies) 0.625

f-test on i (seasonal dummies) 0.474

Residual seasonality (entire series) 0.779

Residual seasonality (last 3 years) 0.878

f-test on sa (td) 0.076

f-test on i (td) 0.385

Additional output variables1.3 Manipuler les objets Java

L’objectif de cette partie est de manipuler la fonction jx13() pour gagner en temps de calcul.

Créer un modèle à partir de la fonction jx13() et la spécification sans effet graduel de pâques crée dans la section 1.1.

myjsa <- jx13(ipi_c_eu[, "FR"], spec_sans_easter)

get_indicators(myjsa, "sa")$sa

Jan Feb Mar Apr May Jun Jul

1990 93.27297 96.29529 94.47992 93.73334 93.94507 92.83948 94.28898

1991 93.61809 93.12145 92.56800 92.23966 88.02740 94.55282 92.48219

1992 91.62891 91.43164 92.38484 92.19526 91.08704 90.59578 89.51814

1993 87.30634 87.99736 86.85921 86.97894 86.99296 87.29234 86.76534

1994 88.69622 87.77278 88.37550 89.30617 91.27332 91.48108 90.65425

1995 95.09916 94.52731 93.92731 93.90941 92.37904 92.04264 93.77960

1996 93.06670 91.54362 94.26169 93.30918 91.32878 94.96354 94.26156

1997 93.06742 95.67044 95.13059 101.85852 96.43204 98.44794 98.23010

1998 102.13804 103.25275 102.01932 102.89690 103.62209 101.81934 103.60992

1999 103.71964 102.64444 103.76759 104.04665 106.13300 106.82584 105.69365

2000 110.38789 107.38428 109.60527 110.17270 114.61835 106.35539 110.67086

2001 112.45025 113.34404 113.88119 110.73914 111.61677 111.49774 112.13527

2002 110.26696 110.99285 111.13280 111.58735 107.54579 111.87216 110.92070

2003 108.72641 109.77205 109.75157 109.85823 105.81090 105.36978 108.56247

2004 109.12622 109.43552 109.52322 110.42603 111.47708 112.70525 111.38248

2005 114.72877 111.07384 106.23729 114.40231 113.83685 111.14636 109.33782

2006 112.84431 110.57123 111.88826 111.79247 114.34733 112.62975 111.48879

2007 112.53191 114.29580 114.23700 113.06787 112.93424 115.43386 116.32302

2008 114.06045 113.94480 111.07963 118.83142 111.92185 110.96502 111.54674

2009 93.60983 93.32624 92.17978 92.82197 94.61843 94.29186 94.42552

2010 95.51379 96.12075 98.46494 99.01596 102.81820 100.22951 99.30088

2011 104.88512 104.72507 103.63569 102.25128 116.10802 97.55663 101.60353

2012 102.83064 98.48657 101.60323 99.95552 99.30289 100.25687 101.48753

2013 97.45647 98.45690 97.93752 100.35136 99.79029 100.14504 100.08302

2014 97.89835 100.00657 98.78845 99.56271 98.29814 97.26484 98.38400

2015 98.27255 99.53811 99.50288 99.07983 99.28072 101.49169 96.66780

2016 101.32397 99.22467 96.95194 102.97678 105.03035 100.37169 96.68839

2017 102.72859 101.41668 102.63069 100.60801 106.58076 101.54655 100.67684

2018 103.19713 103.14126 103.70513 103.35321 102.04279 105.47625 105.16178

2019 104.94974 106.21301 104.70704 105.06883 108.70777 101.50380 105.49182

Aug Sep Oct Nov Dec

1990 92.81532 93.42471 93.21965 92.25071 90.06120

1991 91.72254 92.21808 91.96428 92.02285 90.46195

1992 91.95223 89.69252 89.81277 90.02832 88.33305

1993 87.30196 87.03081 87.21300 84.45288 87.46656

1994 91.37247 91.19741 91.98386 92.78677 95.17153

1995 92.38821 93.99473 92.85706 93.36671 94.38969

1996 93.75684 94.14529 93.72433 93.79062 93.43034

1997 101.81145 99.64928 101.86478 100.90774 101.70138

1998 103.62658 103.60456 103.09096 104.46065 102.99964

1999 106.07083 107.12621 108.29389 107.17738 110.10121

2000 111.01860 110.92744 111.42763 113.10692 114.51591

2001 115.50617 111.31601 110.65583 110.20538 108.13496

2002 112.75124 109.55689 109.18036 109.90888 106.38982

2003 107.51695 108.10694 110.01758 109.50133 108.16481

2004 110.31329 111.75188 112.44658 108.46909 111.73847

2005 110.00423 112.59573 109.23754 111.65979 113.81029

2006 112.62602 113.48750 112.76155 112.55067 113.59525

2007 115.82841 112.91803 115.49734 113.69439 112.28630

2008 109.36385 109.09852 108.03726 100.63716 99.86454

2009 96.91866 97.94748 97.85917 97.60414 96.07651

2010 99.54513 100.43464 100.75477 98.83302 102.97020

2011 101.60617 101.45456 102.21445 102.59847 103.85017

2012 101.83135 99.96547 98.23490 98.64730 97.23489

2013 96.84385 97.95614 99.86479 98.42704 97.79728

2014 96.12996 99.28707 98.34888 97.27581 99.01780

2015 102.05354 101.35873 100.66252 100.76102 100.45864

2016 101.62022 100.64268 98.76241 100.83623 102.82647

2017 103.73341 103.82246 105.29816 106.59767 105.53516

2018 105.03058 103.00706 104.49092 104.89205 103.66170

2019 102.63605 104.04393 104.58566 101.77858 101.58827Toujours avec la même spécification, extraire les révisions de la séries désaisonnalisée du point de janvier 2005 (i.e. : série désaisonnalisée lorsqu’on a les données jusqu’en janvier 2005, puis jusqu’en février 2005, etc.).

Récupérer l’ensemble des dates de fin d’estimation avec la fonction window(time(ipi_c_eu[, "FR"]), start = 2005).

dates <- as.numeric(window(time(ipi_c_eu[, "FR"]), start = 2005))

estimations <- sapply(dates, function(last_date_estimation){

myjsa <- jx13(window(ipi_c_eu[, "FR"], end = last_date_estimation), spec_sans_easter)

sa <- get_indicators(myjsa, "sa")$sa

window(sa, start = 2005, end = 2005) # Pour ne récupérer que la valeur en 2005

})

estimations <- ts(estimations, start = 2005, frequency = 12)

plot(estimations)

2 RJDemetra v3

2.1 Créer une specification

Les modèles autour de la méthode X-13ARIMA peuvent être estimés avec rjd3x13::x13(), rjd3x13::regarima()) et rjd3x13::x11().

Les spécifications peuvent être crées avec les fonctions rjd3x13::regarima_spec, rjd3x13::spec_x11() ou rjd3x13::x13_spec() et peuvent être modifiées par :

Pour le préajustement :

rjd3toolkit::set_arima(),rjd3toolkit::set_automodel(),rjd3toolkit::set_basic(),rjd3toolkit::set_easter(),rjd3toolkit::set_estimate(),rjd3toolkit::set_outlier(),rjd3toolkit::set_tradingdays(),rjd3toolkit::set_transform(),rjd3toolkit::add_outlier(),rjd3toolkit::remove_outlier(),rjd3toolkit::add_ramp(),rjd3toolkit::remove_ramp(),rjd3toolkit::add_usrdefvar();Pour la décomposition :

rjd3x13::set_x11();Pour le benchmarking :

rjd3toolkit::set_benchmarking().

Faire la désaisonnalisation d’une série avec X-13 avec la spécification suivante :

- détection automatique du schéma de décomposition, des outliers et du modèle ARIMA ;

- une correction des jours ouvrables “working days” et un effet graduel de Pâques.

Faire ensuite un graphique avec la série brute et la série désaisonnalisée.

Utiliser la spécification RSA4c pour la désaisonnalisation.

Si le modèle créé s’appelle sa_jd3, regarder les valeurs de sa_jd3$result$final et rjd3toolkit::sa_decomposition(sa_jd3).

sa_jd3 <- rjd3x13::x13(ipi_c_eu[, "FR"], "rsa4")

sa_jd3RegARIMA

Log-transformation: yes

SARIMA model: (2,1,1) (0,1,1)

Coefficients

Estimate Std. Error T-stat

phi(1) 0.02269 0.10769 0.211

phi(2) 0.15463 0.07367 2.099

theta(1) -0.52470 0.09974 -5.261

btheta(1) -0.70977 0.04324 -16.415

Regression model:

Estimate Std. Error T-stat

td 0.0070856 0.0002973 23.830

easter -0.0218293 0.0041947 -5.204

LS (2008-11-01) -0.0851379 0.0169175 -5.033

LS (2009-01-01) -0.0720198 0.0168966 -4.262

AO (2011-05-01) 0.1267563 0.0170943 7.415

Number of observations: 360

Number of effective observations: 347

Number of parameters: 10

Loglikelihood: 850.2857

Adjusted loglikelihood: -752.4816

Standard error of the regression (ML estimate): 0.02060681

AIC: 1524.963

AICC: 1525.618

BIC: 1563.456

Decomposition

Monitoring and Quality Assessment Statistics:

M stats

m1 0.087

m2 0.049

m3 0.934

m4 0.713

m5 0.965

m6 0.212

m7 0.075

m8 0.198

m9 0.070

m10 0.209

m11 0.195

q 0.340

qm2 0.376

Final filters:

Seasonal filter:

Trend filter: 13 terms Henderson moving average

Diagnostics

Relative contribution of the components to the stationary

portion of the variance in the original series,

after the removal of the long term trend (in %)

Component

cycle 8.148

seasonal 53.817

irregular 0.338

calendar 2.074

others 30.402

total 94.779

Residual seasonality tests

P.value

seas.ftest.i 0.122

seas.ftest.sa 0.486

seas.qstest.i 0.600

seas.qstest.sa 0.788

td.ftest.i 0.383

td.ftest.sa 0.420

Final

Last values

series sa trend seas irr

Jan 2019 103.9 104.9459 104.8892 0.9900340 1.0005406

Feb 2019 101.9 106.1674 105.2359 0.9598051 1.0088514

Mar 2019 111.0 104.5521 105.4496 1.0616713 0.9914890

Apr 2019 107.4 105.9774 105.4357 1.0134233 1.0051380

May 2019 105.5 108.7623 105.2678 0.9700057 1.0331958

Jun 2019 105.8 101.1875 104.9615 1.0455836 0.9640439

Jul 2019 110.1 105.3177 104.5343 1.0454088 1.0074942

Aug 2019 78.7 102.5250 104.0408 0.7676178 0.9854307

Sep 2019 108.5 104.0024 103.5185 1.0432448 1.0046754

Oct 2019 116.8 104.5360 103.0474 1.1173179 1.0144465

Nov 2019 103.8 101.7273 102.7183 1.0203752 0.9903519

Dec 2019 97.7 101.6177 102.5972 0.9614465 0.9904527y <- sa_jd3$result$preadjust$a1

sa <- sa_jd3$result$final$d11final

# ou :

decomp <- rjd3toolkit::sa_decomposition(sa_jd3)

y <- decomp$series

sa <- decomp$sa

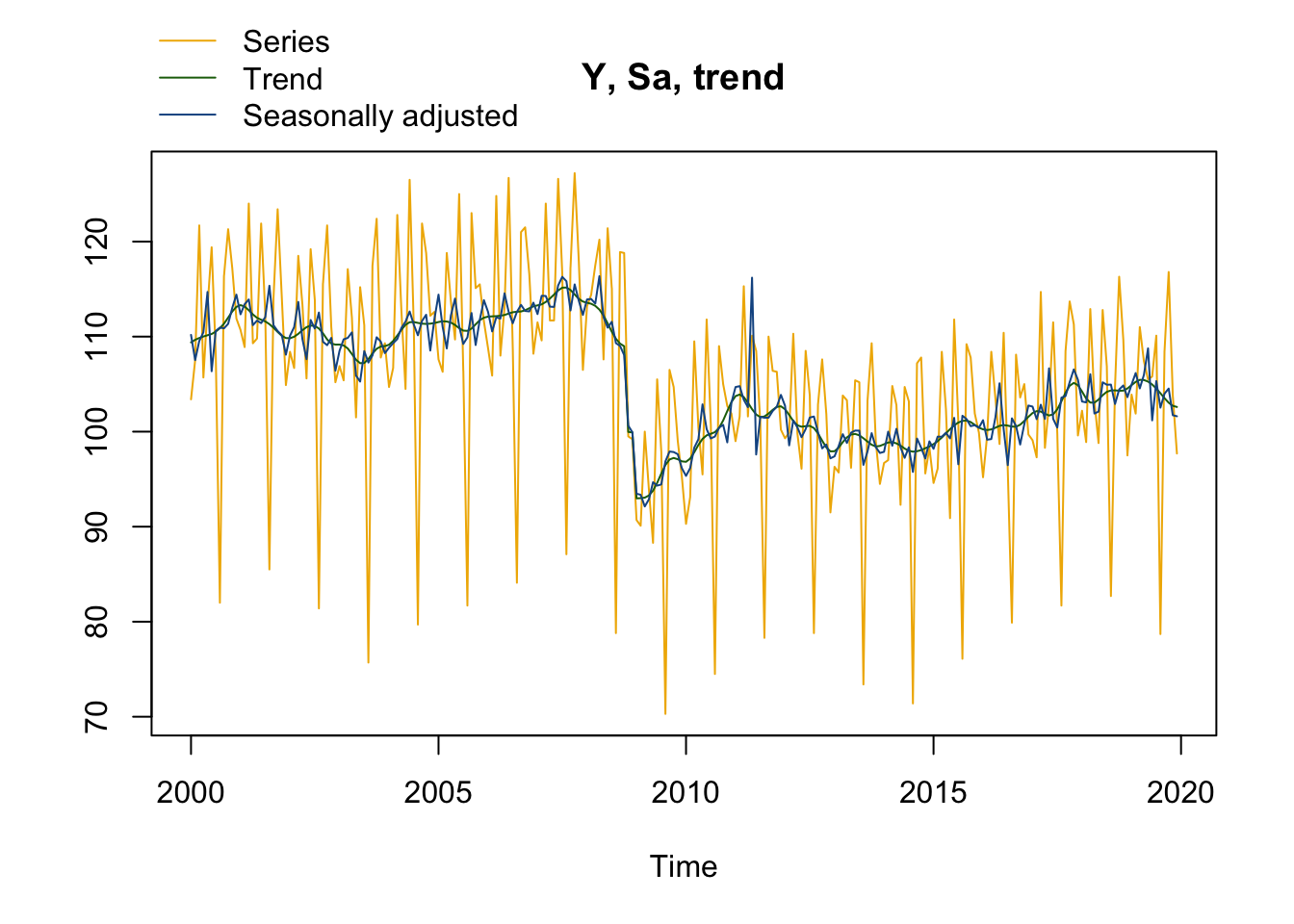

# ou on peut directement utiliser les fonctions de rjd3x13 :

plot(sa_jd3, first_date = 2000 #Pour n'afficher le graphique qu'à partir de 200

)

Pour des graphiques ggplot2, on peut également utiliser le package ggdemetra3.

Modifier le modèle précédent pour enlever l’effet graduel de Pâques.

spec_sans_easter_v3 <-

sa_jd3$estimation_spec |>

rjd3toolkit::set_easter(enabled = FALSE)

sa2_jd3 <- rjd3x13::x13(ipi_c_eu[, "FR"], spec_sans_easter_v3)

sa2_jd3$result$preprocessingLog-transformation: yes

SARIMA model: (2,1,1) (0,1,1)

Coefficients

Estimate Std. Error T-stat

phi(1) 0.05029 0.10689 0.470

phi(2) 0.09574 0.07647 1.252

theta(1) -0.55562 0.09576 -5.802

btheta(1) -0.73033 0.03972 -18.387

Regression model:

Estimate Std. Error T-stat

td 0.0071788 0.0003171 22.637

LS (2008-11-01) -0.0869273 0.0171661 -5.064

LS (2009-01-01) -0.0710048 0.0171448 -4.141

AO (2011-05-01) 0.1242974 0.0180391 6.890

Number of observations: 360

Number of effective observations: 347

Number of parameters: 9

Loglikelihood: 838.005

Adjusted loglikelihood: -764.7623

Standard error of the regression (ML estimate): 0.02132569

AIC: 1547.525

AICC: 1548.059

BIC: 1582.168 Calculer les p-valeurs associées au modèle Reg-ARIMA de la précédente spécification.

Récupérer le modèle Reg-ARIMA et utiliser la fonction summary().

summary(sa2_jd3$result$preprocessing)Log-transformation: yes

SARIMA model: (2,1,1) (0,1,1)

Coefficients

Estimate Std. Error T-stat Pr(>|t|)

phi(1) 0.05029 0.10689 0.470 0.638

phi(2) 0.09574 0.07647 1.252 0.211

theta(1) -0.55562 0.09576 -5.802 1.5e-08 ***

btheta(1) -0.73033 0.03972 -18.387 < 2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Regression model:

Estimate Std. Error T-stat Pr(>|t|)

td 0.0071788 0.0003171 22.637 < 2e-16 ***

LS (2008-11-01) -0.0869273 0.0171661 -5.064 6.76e-07 ***

LS (2009-01-01) -0.0710048 0.0171448 -4.141 4.36e-05 ***

AO (2011-05-01) 0.1242974 0.0180391 6.890 2.72e-11 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Number of observations: 360 , Number of effective observations: 347 , Number of parameters: 9

Loglikelihood: 838.005, Adjusted loglikelihood: -764.7623

Standard error of the regression (ML estimate): 0.02132569

AIC: 1547.525 , AICc: 1548.059 , BIC: 1582.168 2.2 Créer un workspace

Dans cette partie nous allons créer un workspace depuis R. Pour cela les fonctions qui peuvent être utilisées sont rjdemetra3::.jws_new(), rjdemetra3::read_workspace(), rjdemetra3::.jws_sap_new(), rjdemetra3::add_sa_item(), rjdemetra3::save_workspace().

Créer un workspace qui va contenir une série désaisonnalisée selon 3 spécifications différentes.

jws <- rjdemetra3::.jws_new()

jsap <- rjdemetra3::.jws_sap_new(jws, "MP-1")

rjdemetra3::add_sa_item(jsap, "X13 avec Pâques", sa_jd3)

rjdemetra3::add_sa_item(jsap, "X13 sans Pâques", sa2_jd3)

rjdemetra3::add_sa_item(jsap, "TRAMO-SEATS", y, rjd3tramoseats::spec_tramoseats())

rjdemetra3::save_workspace(jws, "ws_v3.xml")Importer le workspace précédent et récupérer :

- Le nom du premier multi-processing

- Le nombre de modèles dans ce premier multi-processing

- L’ensemble des séries brutes

- Le 2ème modèle

# charge tous les modèles du workspace :

jws <- rjdemetra3::.jws_load("ws_v3.xml")

ws <- rjdemetra3::read_workspace(jws)

names(ws$processing)[1][1] "MP-1"length(ws$processing[[1]]) # Nombre de multiprocessing[1] 3Autre façon de faire similaire à RJDemetra :

# charge tous les modèles du workspace :

jws <- rjdemetra3::.jws_load("ws_v3.xml")

rjdemetra3::.jws_compute(jws)

rjdemetra3::.jws_sap_count(jws) # Nombre de multiprocessing[1] 1jsap1 <- rjdemetra3::.jws_sap(jws, 1) # Le premier multiprocessing

rjdemetra3::.jsap_name(jsap1)[1] "MP-1"rjdemetra3::.jsap_sa_count(jsap1)[1] 3model2 <- rjdemetra3::.jsap_sa(jsap1, 2) # On récupère l'objet associé au 2ème modèle

rjdemetra3::.jsa_read(model2)$ts

$name

[1] "X13 sans Pâques"

$moniker

$source

[1] ""

$id

[1] "f15592ce-2d48-4450-89ca-5a2f3a8f4644"

attr(,"class")

[1] "JD3_TSMONIKER"

$metadata

NULL

$data

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

1990 92.1 92.3 102.1 93.0 93.3 100.8 92.9 66.7 95.8 105.0 96.7 89.2

1991 92.5 89.2 97.4 93.8 87.5 100.3 93.4 64.3 96.9 103.5 94.0 92.1

1992 90.7 89.0 99.4 93.7 86.1 101.3 90.4 62.9 96.6 98.4 91.9 92.6

1993 82.3 84.0 95.6 88.3 82.2 97.9 85.5 61.3 93.7 93.0 88.3 92.1

1994 83.6 83.7 97.0 88.3 88.3 102.9 87.3 65.9 98.2 98.0 96.8 98.0

1995 91.8 90.1 102.9 90.4 91.6 103.7 90.6 66.8 98.7 101.4 97.2 94.8

1996 92.0 91.1 98.1 94.3 90.5 101.8 96.1 66.3 98.9 105.0 95.0 96.0

1997 91.9 91.3 99.1 102.8 93.2 108.2 100.4 70.5 107.3 114.1 99.6 106.7

1998 98.2 98.7 109.3 103.7 97.6 114.7 106.1 72.1 111.5 112.6 105.6 107.4

1999 97.2 98.3 114.5 104.8 99.9 120.2 105.7 76.1 115.2 115.1 111.1 114.0

2000 103.4 107.5 121.7 105.7 113.1 119.4 108.1 82.0 116.4 121.3 117.2 111.9

2001 110.7 108.9 124.0 109.3 109.8 121.9 112.4 85.5 114.1 123.4 114.2 104.9

2002 108.4 106.7 118.5 113.4 105.6 119.2 113.9 81.4 115.6 121.7 111.0 105.2

2003 106.9 105.4 117.1 112.0 101.5 115.2 111.2 75.7 117.5 122.4 107.8 109.3

2004 104.7 106.7 122.8 112.7 104.5 126.5 111.1 79.7 121.9 118.8 112.2 112.6

2005 107.6 106.3 118.8 113.7 109.7 125.0 106.4 81.7 123.0 115.1 115.5 111.6

2006 108.8 105.9 124.8 108.0 113.1 126.7 108.7 84.1 121.0 121.5 116.6 108.2

2007 111.5 109.6 124.0 111.7 111.7 126.6 116.6 87.1 117.3 127.2 118.0 106.5

2008 113.2 114.4 117.5 120.2 107.6 121.4 115.1 78.8 118.9 118.8 99.5 99.2

2009 90.7 90.1 100.0 93.9 88.3 105.5 97.9 70.3 106.5 104.7 99.0 95.2

2010 90.3 93.1 109.5 100.4 95.5 111.8 100.8 74.5 109.0 105.0 102.7 101.9

2011 99.0 101.6 115.3 101.6 110.1 108.5 101.0 78.3 110.0 106.4 106.3 100.2

2012 99.3 99.9 110.3 99.8 96.1 108.5 103.8 78.8 102.9 107.6 101.9 91.5

2013 96.3 95.7 103.8 103.3 96.2 105.4 105.2 73.4 103.3 109.3 99.0 94.5

2014 96.7 97.0 104.8 102.8 92.3 104.7 103.2 71.4 107.2 107.8 95.6 98.3

2015 94.6 96.1 108.4 102.4 90.9 111.8 101.1 76.1 109.2 107.8 101.9 99.9

2016 95.2 99.6 108.4 103.5 98.7 110.4 95.9 79.9 108.1 103.6 105.0 99.7

2017 99.1 97.3 114.7 98.3 102.9 111.5 99.8 81.7 108.5 113.7 111.3 99.6

2018 102.2 98.9 112.9 103.2 98.8 112.8 106.9 82.7 104.8 116.3 109.7 97.5

2019 103.9 101.9 111.0 107.4 105.5 105.8 110.1 78.7 108.5 116.8 103.8 97.7

attr(,"class")

[1] "JD3_TS"

$domainSpec

Specification

Series

Serie span: All

Preliminary Check: Yes

Estimate

Model span: All

Tolerance: 1e-07

Transformation

Function: AUTO

AIC difference: -2

Adjust: NONE

Regression

Calendar regressor: WorkingDays

with Leap Year: Yes

AutoAdjust: TRUE

Test: REMOVE

Easter: No

Pre-specified outliers: 0

Ramps: No

Outliers

Detection span: All

Outliers type:

- AO, critical value : 0 (Auto)

- LS, critical value : 0 (Auto)

- TC, critical value : 0 (Auto)

TC rate: 0.7 (Auto)

Method: ADDONE (Auto)

ARIMA

SARIMA model: (0,1,1) (0,1,1)

Coefficients

Estimate Type

theta(1) 0 UNDEFINED

btheta(1) 0 UNDEFINED

Specification X11

Seasonal component: Yes

Length of the Henderson filter: 0

Seasonal filter: FILTER_MSR

Boundaries used for extreme values correction :

lower_sigma: 1.5

upper_sigma: 2.5

Nb of forecasts: -1

Nb of backcasts: 0

Calendar sigma: NONE

Benchmarking

Is enabled: No

$estimationSpec

Specification

Series

Serie span: All

Preliminary Check: Yes

Estimate

Model span: All

Tolerance: 1e-07

Transformation

Function: AUTO

AIC difference: -2

Adjust: NONE

Regression

Calendar regressor: WorkingDays

with Leap Year: Yes

AutoAdjust: TRUE

Test: REMOVE

Easter: No

Pre-specified outliers: 0

Ramps: No

Outliers

Detection span: All

Outliers type:

- AO, critical value : 0 (Auto)

- LS, critical value : 0 (Auto)

- TC, critical value : 0 (Auto)

TC rate: 0.7 (Auto)

Method: ADDONE (Auto)

ARIMA

SARIMA model: (0,1,1) (0,1,1)

Coefficients

Estimate Type

theta(1) 0 UNDEFINED

btheta(1) 0 UNDEFINED

Specification X11

Seasonal component: Yes

Length of the Henderson filter: 0

Seasonal filter: FILTER_MSR

Boundaries used for extreme values correction :

lower_sigma: 1.5

upper_sigma: 2.5

Nb of forecasts: -1

Nb of backcasts: 0

Calendar sigma: NONE

Benchmarking

Is enabled: No

$pointSpec

Specification

Series

Serie span: All

Preliminary Check: Yes

Estimate

Model span: All

Tolerance: 1e-07

Transformation

Function: LOG

AIC difference: -2

Adjust: LEAPYEAR

Regression

Calendar regressor: WorkingDays

with Leap Year: No

AutoAdjust: FALSE

Test: NO

Easter: No

Pre-specified outliers: 3

- LS (2008-11-01), coefficient: -0.0869273387886007 (ESTIMATED)

- LS (2009-01-01), coefficient: -0.0710047923357392 (ESTIMATED)

- AO (2011-05-01), coefficient: 0.124297351091159 (ESTIMATED)

Ramps: No

Outliers

Is enabled: No

ARIMA

SARIMA model: (2,1,1) (0,1,1)

Coefficients

Estimate Type

phi(1) 0.05029197 ESTIMATED

phi(2) 0.09573828 ESTIMATED

theta(1) -0.55562180 ESTIMATED

btheta(1) -0.73032859 ESTIMATED

Specification X11

Seasonal component: Yes

Length of the Henderson filter: 0

Seasonal filter: FILTER_MSR

Boundaries used for extreme values correction :

lower_sigma: 1.5

upper_sigma: 2.5

Nb of forecasts: -1

Nb of backcasts: 0

Calendar sigma: NONE

Benchmarking

Is enabled: No

$results

RegARIMA

Log-transformation: yes

SARIMA model: (2,1,1) (0,1,1)

Coefficients

Estimate Std. Error T-stat

phi(1) 0.05029 0.10689 0.470

phi(2) 0.09574 0.07647 1.252

theta(1) -0.55562 0.09576 -5.802

btheta(1) -0.73033 0.03972 -18.387

Regression model:

Estimate Std. Error T-stat

td 0.0071788 0.0003171 22.637

LS (2008-11-01) -0.0869273 0.0171661 -5.064

LS (2009-01-01) -0.0710048 0.0171448 -4.141

AO (2011-05-01) 0.1242974 0.0180391 6.890

Number of observations: 360

Number of effective observations: 347

Number of parameters: 9

Loglikelihood: 838.005

Adjusted loglikelihood: -764.7623

Standard error of the regression (ML estimate): 0.02132569

AIC: 1547.525

AICC: 1548.059

BIC: 1582.168

Decomposition

Monitoring and Quality Assessment Statistics:

M stats

m1 0.080

m2 0.044

m3 0.925

m4 0.324

m5 1.018

m6 0.172

m7 0.075

m8 0.207

m9 0.069

m10 0.229

m11 0.207

q 0.311

qm2 0.344

Final filters:

Seasonal filter:

Trend filter: 13 terms Henderson moving average

Diagnostics

Relative contribution of the components to the stationary

portion of the variance in the original series,

after the removal of the long term trend (in %)

Component

cycle 8.120

seasonal 54.041

irregular 0.305

calendar 1.946

others 30.441

total 94.853

Residual seasonality tests

P.value

seas.ftest.i 0.175

seas.ftest.sa 0.566

seas.qstest.i 0.956

seas.qstest.sa 1.000

td.ftest.i 0.281

td.ftest.sa 0.279

Final

Last values

series sa trend seas irr

Jan 2019 103.9 104.9497 104.8872 0.9899977 1.0005966

Feb 2019 101.9 106.2130 105.1277 0.9593928 1.0103234

Mar 2019 111.0 104.7070 105.2207 1.0601008 0.9951181

Apr 2019 107.4 105.0688 105.1200 1.0221872 0.9995130

May 2019 105.5 108.7078 104.9337 0.9704918 1.0359659

Jun 2019 105.8 101.5038 104.6881 1.0423255 0.9695828

Jul 2019 110.1 105.4918 104.3766 1.0436829 1.0106850

Aug 2019 78.7 102.6360 104.0097 0.7667871 0.9867928

Sep 2019 108.5 104.0439 103.5870 1.0428287 1.0044107

Oct 2019 116.8 104.5857 103.1442 1.1167879 1.0139754

Nov 2019 103.8 101.7786 102.7722 1.0198610 0.9903319

Dec 2019 97.7 101.5883 102.5735 0.9617251 0.9903948# Pour extraire toutes les séries brutes il faut faire une boucle :

all_y <- lapply(

lapply(

seq_len(rjdemetra3::.jsap_sa_count(jsap1)),

rjdemetra3::.jsap_sa, jsap = jsap1

),

rjdemetra3::get_raw_data

)2.3 Manipuler les objets Java

La manipulation des objets Java se fait de la même façon qu’avec RJDemetra : jx13() pour estimer les modèles, rjd3toolkit::dictionary() pour connaitre l’ensemble des objets exportables et rjd3toolkit::result() et rjd3toolkit::user_defined() pour exporter des objets.

Créer un modèle à partir de la fonction jx13() et la spécification sans effet graduel de pâques calculée dans la section 2.1.

myjsa <- rjd3x13::jx13(ipi_c_eu[, "FR"], spec_sans_easter_v3)

rjd3toolkit::result(myjsa, "sa") Jan Feb Mar Apr May Jun Jul

1990 93.27297 96.29529 94.47992 93.73334 93.94507 92.83948 94.28898

1991 93.61809 93.12145 92.56800 92.23966 88.02740 94.55282 92.48219

1992 91.62891 91.43164 92.38484 92.19526 91.08704 90.59578 89.51814

1993 87.30634 87.99736 86.85921 86.97894 86.99296 87.29234 86.76534

1994 88.69622 87.77278 88.37550 89.30617 91.27332 91.48108 90.65425

1995 95.09916 94.52731 93.92731 93.90941 92.37904 92.04264 93.77960

1996 93.06670 91.54362 94.26169 93.30918 91.32878 94.96354 94.26156

1997 93.06742 95.67044 95.13059 101.85852 96.43204 98.44794 98.23010

1998 102.13804 103.25275 102.01932 102.89690 103.62209 101.81934 103.60992

1999 103.71964 102.64444 103.76759 104.04665 106.13300 106.82584 105.69365

2000 110.38789 107.38428 109.60527 110.17270 114.61835 106.35539 110.67086

2001 112.45025 113.34404 113.88119 110.73914 111.61677 111.49774 112.13527

2002 110.26696 110.99285 111.13280 111.58735 107.54579 111.87216 110.92070

2003 108.72641 109.77205 109.75157 109.85823 105.81090 105.36978 108.56247

2004 109.12622 109.43552 109.52322 110.42603 111.47708 112.70525 111.38248

2005 114.72876 111.07384 106.23729 114.40231 113.83685 111.14636 109.33782

2006 112.84430 110.57123 111.88827 111.79247 114.34733 112.62975 111.48879

2007 112.53191 114.29580 114.23701 113.06787 112.93424 115.43386 116.32303

2008 114.06045 113.94479 111.07964 118.83142 111.92185 110.96502 111.54674

2009 93.60983 93.32624 92.17979 92.82197 94.61843 94.29186 94.42552

2010 95.51378 96.12075 98.46495 99.01596 102.81821 100.22951 99.30088

2011 104.88511 104.72507 103.63569 102.25128 116.10803 97.55663 101.60353

2012 102.83064 98.48657 101.60323 99.95552 99.30289 100.25687 101.48753

2013 97.45647 98.45690 97.93752 100.35136 99.79029 100.14504 100.08302

2014 97.89835 100.00657 98.78845 99.56271 98.29814 97.26484 98.38400

2015 98.27255 99.53811 99.50288 99.07983 99.28072 101.49169 96.66780

2016 101.32397 99.22467 96.95194 102.97678 105.03035 100.37169 96.68839

2017 102.72859 101.41668 102.63068 100.60800 106.58076 101.54656 100.67684

2018 103.19713 103.14126 103.70512 103.35321 102.04279 105.47626 105.16178

2019 104.94974 106.21301 104.70703 105.06882 108.70777 101.50380 105.49182

Aug Sep Oct Nov Dec

1990 92.81532 93.42471 93.21965 92.25071 90.06120

1991 91.72254 92.21808 91.96428 92.02285 90.46195

1992 91.95223 89.69252 89.81277 90.02832 88.33305

1993 87.30196 87.03081 87.21300 84.45288 87.46656

1994 91.37247 91.19741 91.98386 92.78677 95.17153

1995 92.38821 93.99473 92.85706 93.36671 94.38969

1996 93.75684 94.14529 93.72433 93.79062 93.43034

1997 101.81145 99.64928 101.86478 100.90774 101.70138

1998 103.62658 103.60456 103.09096 104.46065 102.99964

1999 106.07083 107.12621 108.29389 107.17738 110.10121

2000 111.01860 110.92744 111.42763 113.10692 114.51591

2001 115.50617 111.31601 110.65583 110.20538 108.13496

2002 112.75124 109.55689 109.18036 109.90888 106.38982

2003 107.51695 108.10694 110.01758 109.50133 108.16481

2004 110.31329 111.75189 112.44658 108.46909 111.73847

2005 110.00423 112.59573 109.23755 111.65978 113.81028

2006 112.62602 113.48751 112.76156 112.55066 113.59524

2007 115.82842 112.91804 115.49735 113.69438 112.28629

2008 109.36385 109.09853 108.03727 100.63715 99.86453

2009 96.91866 97.94749 97.85918 97.60413 96.07650

2010 99.54513 100.43465 100.75478 98.83301 102.97020

2011 101.60617 101.45457 102.21445 102.59847 103.85016

2012 101.83135 99.96547 98.23490 98.64730 97.23489

2013 96.84385 97.95614 99.86479 98.42704 97.79728

2014 96.12996 99.28707 98.34888 97.27581 99.01780

2015 102.05354 101.35873 100.66252 100.76102 100.45864

2016 101.62022 100.64268 98.76241 100.83623 102.82647

2017 103.73341 103.82246 105.29816 106.59767 105.53517

2018 105.03057 103.00707 104.49092 104.89205 103.66171

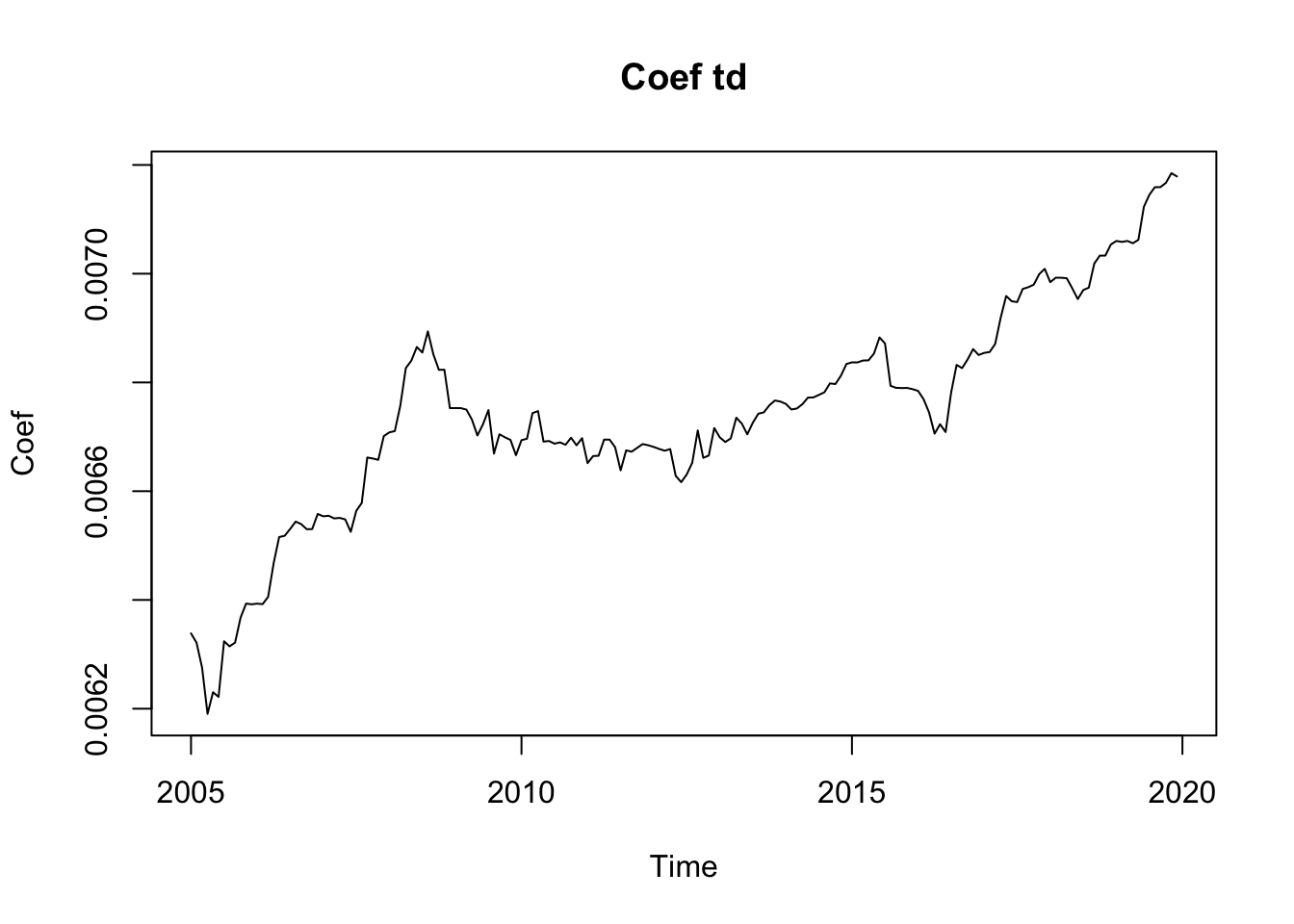

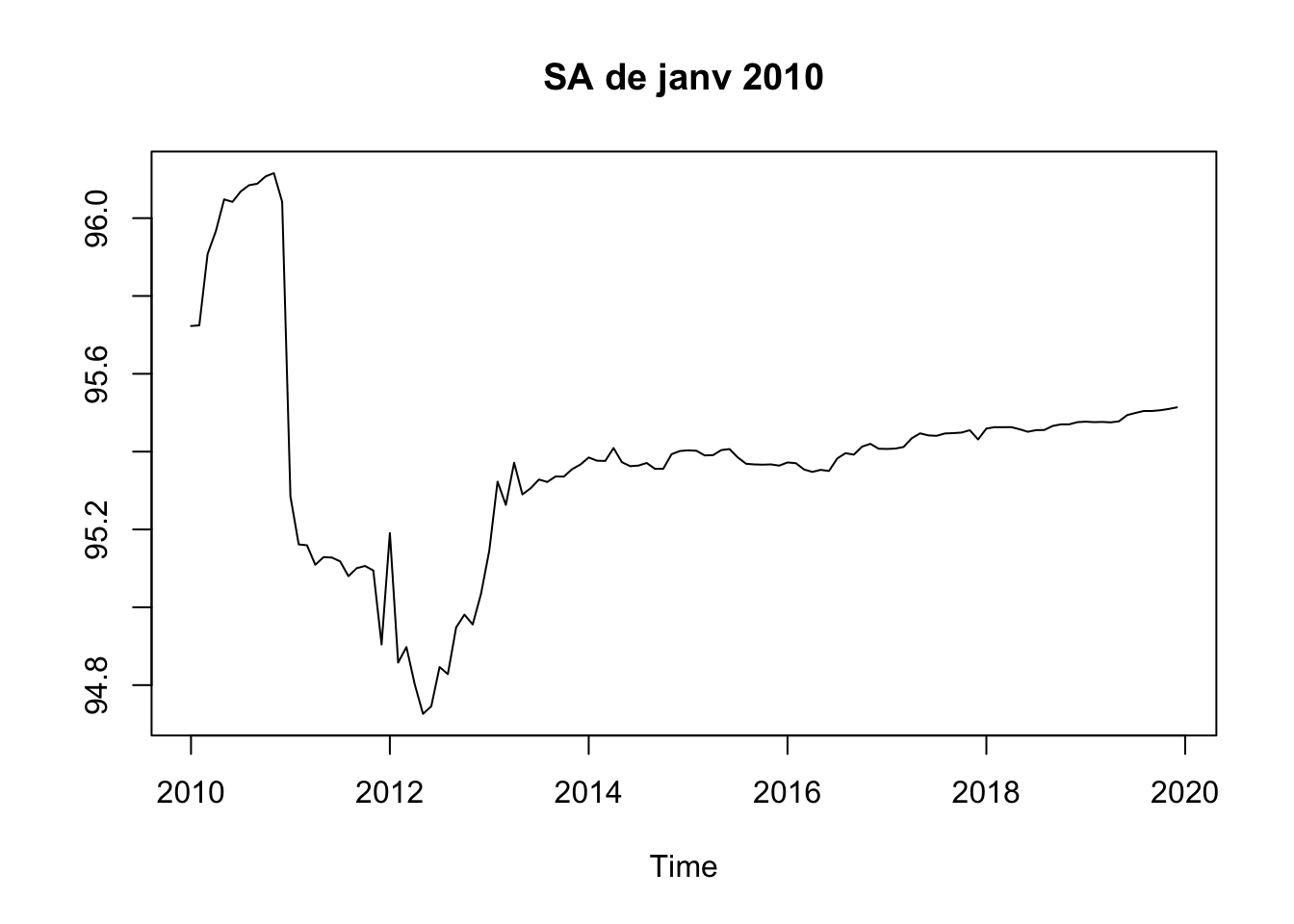

2019 102.63605 104.04393 104.58566 101.77858 101.58828Pour les révisions, la fonction rjd3x13::x13_revisions() facilite grandement la tâche. L’historique des révisions peut s’exporter à partir de trois paramètres :

data_idsqui permet d’exporter des statistiques ;ts_idsqui permet d’exporter des estimations d’une composante à une certaine date ;cmp_idsqui permet l’ensemble des estimations d’une composante à une ensemble de dates.

data_ids <- list(

# Export du coefficient du premier régresseur jours ouvrables

list(start = "2005-01-01", id = "regression.td(1)"))

ts_ids <- list(

# Export de l'historique des estimations de la séries SA de janv 2010 à partir de janvier 2010

list(period = "2010-01-01", start = "2010-01-01", id = "sa"))

cmp_ids <- list(

# Export de l'ensemble des tendances estimées entre janv 2010 et dec 2014

list(start = "2010-01-01", end = "2014-12-01", id = "t"))

rh <- rjd3x13::x13_revisions(

sa2_jd3$result$preadjust$a1,

spec = sa2_jd3$result_spec,

data_ids, ts_ids, cmp_ids)

plot(rh$data$`regression.td(1)`,

ylab = "Coef", main = "Coef td")

plot(rh$series$sa,

ylab = NULL, main = "SA de janv 2010")

ncol(rh$components$t) # nombre de séries exportées[1] 60